_lbl_blog_cases_1_title_

Business loans

Get a business loan, the easy way

Get funding easily at all financiers

More than € 100.000.000 in deals found

Clarity about your financing options within 2 minutes

Save time because we automatically compare all loans for you

Directly apply for the best deal with the help of our financial experts

More than € 100.000.000 in deals found

Login / Register

Reset your password

Compare business loans and get the best deal at:

Get government support here (BMKB)

Get government support here (BMKB)

Get government support here (BMKB)

Rated as excellent by 95.2% of our customers

Know instantly where you can borrow

Our unique system provides funding clarity within 2 minutes based on your bookkeeping. We present you free of charge an overview of the chances, costs and terms per financier. After that, signing the best deal is a piece of cake.

Guidance from our experts

Our financial experts are personally available to help you via chat, telephone or e-mail. Every company is unique and it is our specialty to find the solution that best suits your situation.

You save by getting the best deal

If you want to get the best deal, you must be able to compare financiers first. We do this online and independently for you. If you do this without LoanStreet, requesting multiple offers quickly costs you 20 hours extra, a waste of time.

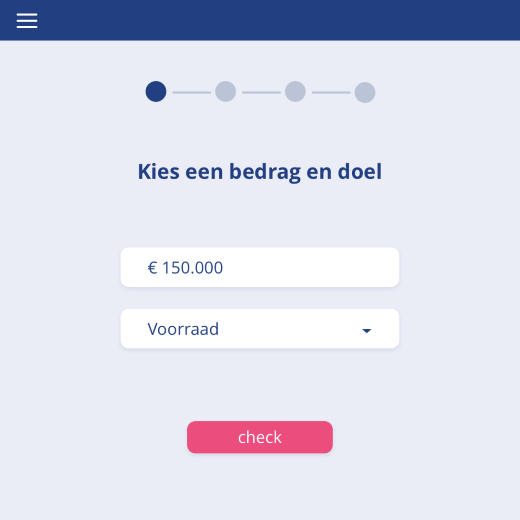

In 4 steps all your funding options

Step 1

Tell us your needs

We help you to find the right loan. Whether you need money for growth, a new machine or extra stock.

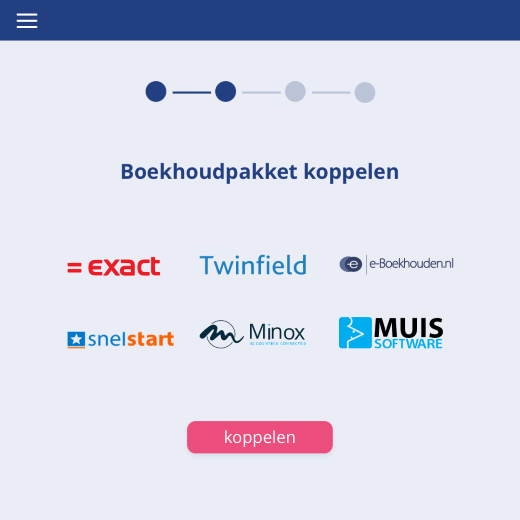

Step 2

Make your offer personal

We save you time by using data from your accounting package. With this we give you a tailor-made offer.

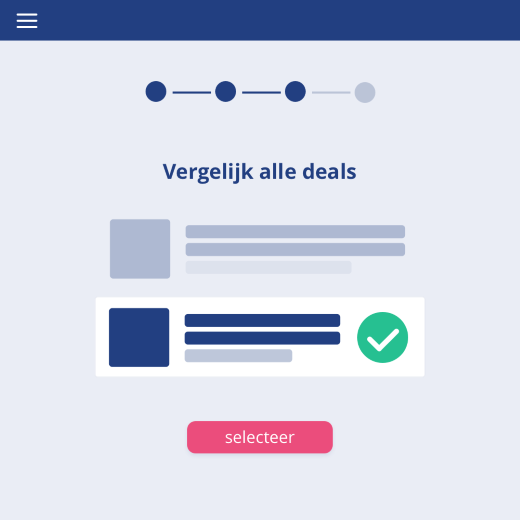

Step 3

An honest comparison

We give you an overview of business loans that meet your needs. Honest, with the best choice at the top.

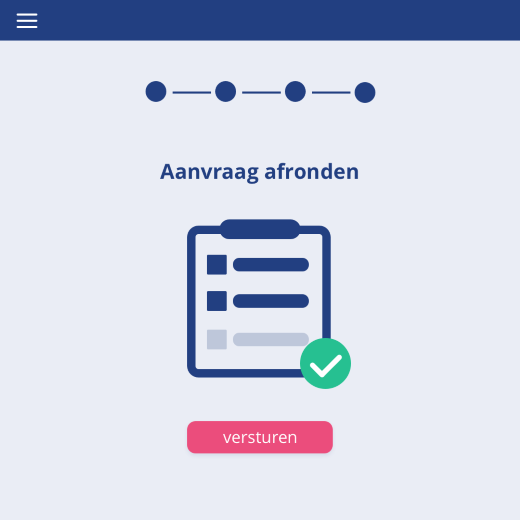

Step 4

Apply for your loan

We help you compare offers. In this way we arrange the best deal together. Completely no cure, no pay.

_lbl_blog_cases_main_title_

_lbl_blog_cases_2_title_

_lbl_blog_cases_3_title_

Frequently asked questions about business loans

What are the costs of LoanStreet?

The success fee is 1% of the financing sum with a minimum of € 750 and a maximum of € 4,000. LoanStreet Trusted Advisors (accountants, bookkeepers and other advisors) receive a 20% discount on the success fee, which means that the success fee is a minimum of € 750 and a maximum of € 3,200.

Depending on where we achieve success, we receive the success fee from you or from the financier. In the latter case, at receiving the loan, you do not have to pay us anything and the invoicing goes through the financier. Regardless of who pays, the best choice is at the top of the comparison you receive, regardless of the compensation we receive. You can also sort the comparison yourself based on success rate or costs.

What are the benefits of applying for a business loan through LoanStreet?

- You know within one minute whether you can get a business loan and where

- You can send the funding request directly to multiple lenders

- Many financiers give you a discount on the interest rate and / or the intake charge

- You can collaborate online in the application with your accountant, advisor or accountant

- No cure no pay, so you only pay when you get a loan