Sergio Torres is co-owner at LoanStreet, an interview with the always smiling analyst

Your money or your life! Tell who are you on?

Haha, well, so Sergio Torres, just turned 51 and father. I am not married, but very happy with my girlfriend. I was born and grew up on the water in Curaçao and I moved to the Netherlands when I was 17 years old. Here I studied business economics at the Free University of Amsterdam and currently I live in Bussum.

Always been busy with figures?

Yes, after my studies I started working as a banking supervisor, I worked for a while in Curaçao and for a while at FDIC in Washington. The work in Washington was exciting for me then, because they had an apartment complex in the company with all the trimmings, which meant that I never actually had to leave my work. I learned a lot there. After that I was active in the accountancy world and then back in the banking system. At Rabobank, I was an account manager and credit analyst, among other things, I was in special management, but actually always related to SMEs. After that I worked at Banque Artesia, I made special financing requests here, I worked on risk models and I also helped clients again when they were in trouble and needed financing.

When did you start for yourself?

I noticed that many SMEs were insufficiently served, consultants often did not come up with a good story and entrepreneurs had to pay a lot. Then I thought it could be done differently and I started for myself in 2003. I started a small company very old school, everything still manually, it had nothing to do with IT. I helped companies with financing applications, investments and during the recession period with the reorganization to try to get those companies on top again. Helping this kind of entrepreneurs, often entrepreneurs who were not found interesting by the larger financiers, gave me enormous satisfaction. I have built up that company to 12 people.

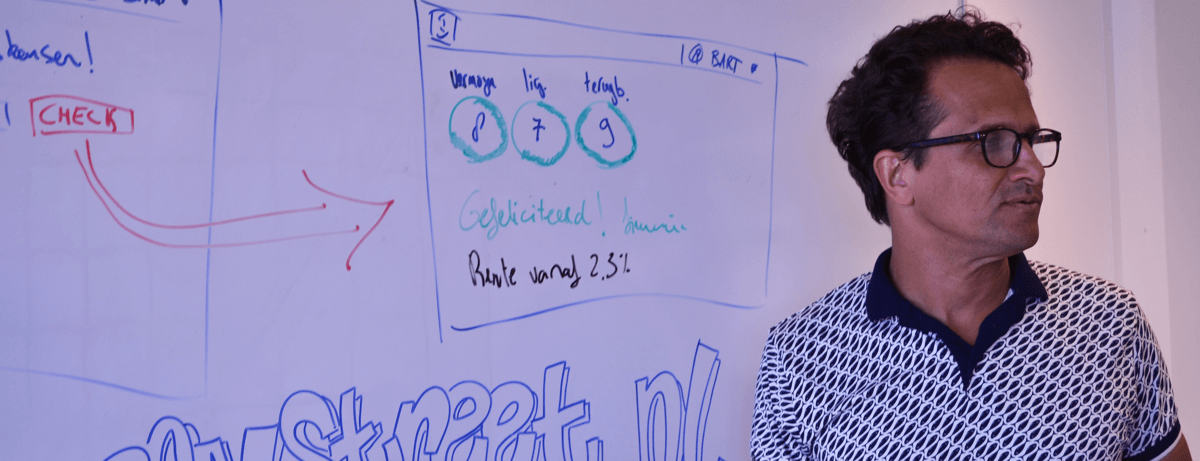

More than 5 years ago, I noticed that I wanted to go further than just advising. I then started Sparkholder, together with Bastiaan Burgwal. From the Sparkholder company, we now develop the LoanStreet software, with which we link to accounting packages and quickly calculate whether someone can be financed or not. This allows you to skip many steps and help the entrepreneur in a focused way. The special thing about entrepreneurs in SMEs is that there are so many of them. It is by far the largest market there is, but this large group is poorly or not served. So what could be nicer to be able to properly help this large group.

How did you get started with Sparkholder?

Well, we had set up a credit union, one of the first in the Netherlands. We thought; we are going to raise money ourselves and thereby finance those SMEs and thus help them further. We were the first alongside the banks that were allowed to finance with a guarantee from the government, but were unable to make a big success of it. I noticed that we were particularly good at analyzing applications and risk assessment, but we were not able to raise money sufficiently. We were able to provide a number of loans with good returns for investors, but it was not enough to grow with the company.

The interview continues below the photo. If you have read enough, you can also immediately check your financing opportunities.

How did you get the idea of what LoanStreet is now?

At the credit union, Bastiaan and I started monitoring companies, so say on a monthly basis to monitor performance and risk. We did this in Excel, where we could load data that was then analyzed semi-automatically. It turned out that in addition to analyzing applications, we were also good at monitoring risk within SMEs. Then we started to work it out; quickly make a risk assessment based on data. At that time, our first real IT employee, Jan-Volkert, joined us and we started working on a digital application street with monitoring.

What is your role in this?

My role is in particular that I know a lot about risks. I can assess them and translate how they should be processed within a model, so that it can be assessed whether someone can be financed. In addition, I also make many contacts with financiers, packages and with the entrepreneurs. So I'm about sales and risk models. We are a small organization so you have to take on a number of functions.

How much money is on average financed by LoanStreet?

Around 40 million and that is amounts from 5,000 euros. We focus on smaller financing, since the average financing for an SME entrepreneur is 70,000. We also see this on our platform, where the average application is also around that amount. That this amount is not that large is something that many people do not know. The largest loan that most SME entrepreneurs will ever take is with regard to their home, the mortgage.

How many hours do you work in a week?

That is not so bad, but I like to get up early. The alarm clock rings at five o'clock, so that I can get up quietly and then I start reading a bit and a quiet breakfast. I also try every day to read something new, just to gain knowledge. Then I set up a calendar for the day and then I start with my emails and the day really begins. Such a day often ends around six o'clock, but when I think I need a break, I don't hesitate to take one. I think that I actually work around 60 hours a week, so that is not so bad haha! I always sleep early, around 10 o'clock I am asleep, so that I can start early the next day. My mother's side of the family comes from Sloten, Amsterdam, they were farmers and my grandfather was always an early bird, so maybe I copied it, who knows.

What do you like to do in your free time?

I mainly spend my free time with my family. I like to go out with my son, for example we go cycling or do creative things together. We sometimes build a castle together in the garden or we make up stories. Something that always helps me enormously at the end of the day is a kind of meditation. Then I put on some music and try to make 10,000 steps by just dancing. That always brings me to rest, clears my head and gives me new ideas.

And what kind of ideas are they usually?

It could be anything. For example, what I am going to say during an important meeting or a solution to a problem. I often have an idea and I immediately put it on paper. After that it starts to grind in my head and then it takes a while before we really do something with it within the company.

And do you listen to Jan Smit or ABBA?

Haha, I listen to almost all types of music. It goes from classical, to rock, to house, which I feel like at the moment.

And how many people are now employed?

We currently have seven people in Amstelveen. It is still a big challenge to find good programmers, but the good thing is that we now have employees who really enjoy the work and think along with us within the company.

What is the purpose of your business, where do you want to go?

Yes, I am often asked that question, but the focus is mainly on making SMEs more financially financeable. Continuously working and improving on this and the rest will come naturally.