LoanStreet always works on a no cure no pay basis when the application is made via our platform. This means that we only get paid a success fee if we manage to realize a deal for you. The success fee is meant to keep interests in line, whereby we both benefit from a good solution.

The success fee is 1% of the financing sum with a minimum of € 750 and a maximum of € 4,000. LoanStreet Trusted Advisors (accountants, bookkeepers and other advisors) receive a 20% discount on the success fee, which means that the success fee is a minimum of € 750 and a maximum of € 3,200.

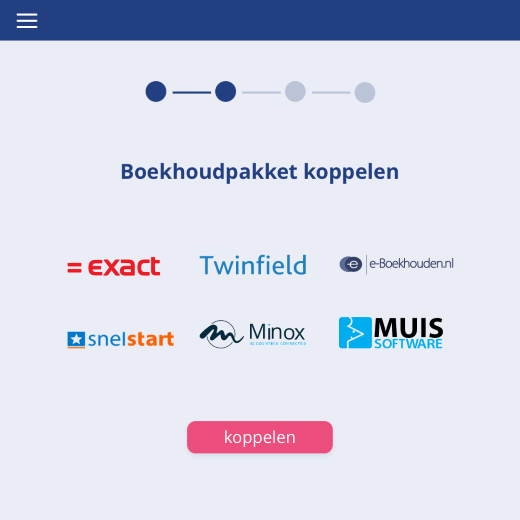

Depending on where we achieve success, we receive the success fee from you or from the financier. In the latter case, at receiving the loan, you do not have to pay us anything and the invoicing goes through the financier. Regardless of who pays, the best choice is at the top of the comparison you receive, regardless of the compensation we receive. You can also sort the comparison yourself based on success rate or costs.

- You know within one minute whether you can get a business loan and where

- You can send the funding request directly to multiple lenders

- Many financiers give you a discount on the interest rate and / or the intake charge

- You can collaborate online in the application with your accountant, advisor or accountant

- No cure no pay, so you only pay when you get a loan

The financiers behind LoanStreet offer business loans and other forms of credit when your company is established in the Netherlands and is registered with the Chamber of Commerce. Most financiers also have a minimum duration of 1 or 2 years, in order to be able to assess your performance. The (legal) form of the company is usually less important, but a VAT number is necessary. Finally, it is especially important how your company performs. Based on, among other things, the loss and profit and balance sheet, it is determined whether your company can repay the business loan.

Most financiers affiliated with LoanStreet work with a (one-off) closing fee and interest during the term of the loan. The commission can be a fixed amount, or can be calculated over the principal amount of the loan. The interest is always calculated on the financing sum that is still open at that moment. On the financiers page you can view the costs and structure per financier and also compare financiers to get a good insight into the costs associated with taking out a business loan.

This differs per financier. Depending on the financiers you select on LoanStreet you will be asked to also provide a business plan. More and more financiers are placing greater emphasis on the historical figures instead of the business plan. Financiers, such as crowdfunders, who do ask for a business plan, mainly do this to test the future creditworthiness and viability of your company. Based on the business plan, they try to estimate whether the future performance will be good enough to pay the repayment and interest of the company financing.

This depends mainly on the performance of your company. The most important thing is that you can pay the financing costs, consisting of interest and repayment. This also depends on the term of the business loan. With a longer term, for example for the purchase of a business building, the repayment is spread over a longer period. As a result, the repayment amounts on an annual basis are often smaller. With a shorter term you can often borrow less, because this puts more pressure on your company. It is especially important not to borrow too much money, so as not to put your company in trouble.

If your company is a BV, NV, VOF, sole proprietorship, CV, cooperative, partnership, foundation or association you can use LoanStreet. You are personally liable for most of the legal forms. With a BV or NV this does not have to be the case. In principle, the company is liable there. The financier may, however, request a personal guarantee. If you are personally liable, or the financier expects a personal guarantee from a BV or NV, you can also be held personally liable if the company can not repay the debts.

The term of a loan differs per financier and per target. Some financing targets, for example a business building, have a longer term. The duration of this is often 20 to 30 years. Business loans for other purposes have a term that is linked to what you want to do with the money. A machine or a means of transport often assumes a lifespan of 5 years, which will then also be the term of the loan. Furthermore, the term depends on the amount you request and to what extent you can pay back within a certain period. A current account is an exception to this. You can often use a bank overdraft indefinitely to a maximum amount, the credit limit.

Most financiers expect a certain form of collateral. If the financing is used for the purchase of a business building, a machine or a means of transport, this is often given as collateral for the business loan to the financier. In addition, a financier may also request additional collateral, for example in the form of a personal guarantee, stock or debtors. Financiers ask for collateral as extra security, so that if you can not repay the loan, the financier can use the collateral as security.

In the past, a penalty interest was very common, nowadays it differs per financier and sometimes also per term. If a financier provides you with a loan for a long term, the financier will take certain revenues into account. If you then redeem the financing earlier and the financier can only lend the money to someone else at a lower interest rate, you may have to pay a fine. Sometimes, however, it can still pay to transfer the financing, because the interest benefit is greater than the penalty interest you have to pay.

How quickly you can dispose of your business loan depends on a number of factors. Whether your application is complete and which processes a financier uses in his assessment process. Many financiers strive to give financial clarity within a few days. Some financiers behind LoanStreet provide clarity even within 24 or 48 hours. The money can then quickly be in your account. Usually, after a positive credit decision, the money is on your account within 1 day to 1 week. With some financiers, including crowdfunders, the lead time is longer. You also have an influence on how quickly your funding request is assessed. Via LoanStreet you can submit a complete application to financiers, this ensures that the assessment time is significantly shortened and you have the money in your account.